Understanding the Registered Education Savings Plan (RESP)

Planning for your child’s education can be both exciting and overwhelming. The rising costs of post-secondary education make it important for parents and families to consider the financial tools available to help ensure children have the opportunity to pursue their educational dreams. One such tool is the Registered Education Savings Plan (RESP), a tax-deferred savings account specifically designed to help save for a child’s post-secondary education in Canada.

Eligibility and How to Open an RESP

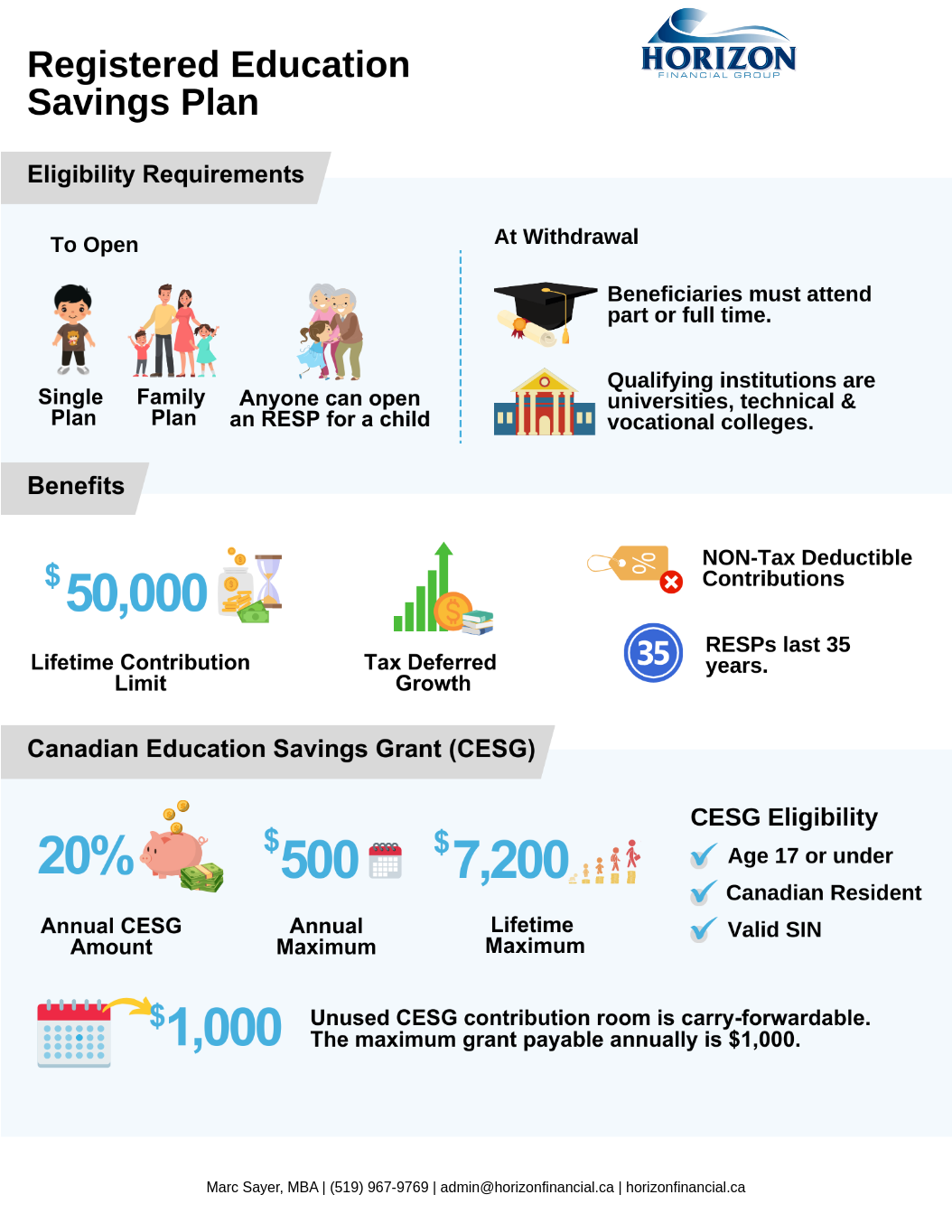

You can open a Single Plan for an individual beneficiary, such as your child, or a Family Plan if you wish to contribute to the education of multiple children in your family. The great news is that anyone can open an RESP for a child, whether you’re a parent, grandparent, or other family member, making it a versatile option for educational savings.

RESP Withdrawals and Beneficiary Requirements

RESPs can be used to cover a broad range of educational expenses. The only stipulation is that the beneficiary must attend a qualifying educational institution, which could be a university, college, or technical or vocational school. Withdrawals from the RESP will help support tuition, textbooks, living expenses, and more, as long as the student is enrolled part-time or full-time.

Key Benefits of an RESP

RESPs come with a range of benefits that make them an attractive savings vehicle for education:

– Lifetime Contribution Limit: You can contribute up to $50,000 over the lifetime of the plan for each beneficiary.

– Tax-Deferred Growth: While contributions to an RESP are not tax-deductible, the investment growth within the plan is tax-deferred. This allows your savings to grow faster, as taxes on the earnings are deferred until the funds are withdrawn.

– RESP Duration: You can keep the plan open for up to 35 years, giving you ample flexibility for when the funds may be needed.

Canadian Education Savings Grant (CESG)

One of the biggest incentives for opening an RESP is the Canadian Education Savings Grant (CESG). Through this program, the government will match 20% of your annual contributions, up to a maximum of $500 per year. Over time, this can accumulate to a lifetime maximum of $7,200 in CESG funds for each child. If you’re unable to contribute the maximum amount in a given year, the unused CESG contribution room is carry-forwardable, and you may be able to receive up to $1,000 in grant payments annually in future years.

Eligibility for CESG

To qualify for the CESG, the beneficiary must be:

– 17 years of age or younger

– A Canadian resident

– In possession of a valid Social Insurance Number (SIN)

A Smart Way to Save for the Future

Starting an RESP early can make a significant difference in how much you can save for your child’s education. With contributions that grow tax-deferred, along with generous government grants like the CESG, the RESP is a valuable tool to help ease the financial burden of post-secondary education. Planning for your child’s future today ensures that when the time comes, they can focus on their studies without worrying about the costs.

Consider opening an RESP to take advantage of the substantial benefits and opportunities this plan offers. Start investing in your child’s future today!