The Coronavirus disease has created challenges across Canada and the world. It’s important to stay informed and educated so you’re equipped to take care of yourself, your family and your business.

We are ready to serve you and answer any questions you have about your employee benefits, insurance and investment. Please feel free to contact us if you have any questions. We are here for you.

Expanded eligibility for Canada Emergency Response Benefit (CERB) & Boosted wages for Essential Workers

Prime Minister Justin Trudeau announced:

"Today, we're announcing more help for more Canadians. This includes topping up the pay of essential workers. At the same time, we'll also be expanding the Canada Emergency Response Benefit to reach people who are earning some income as well as seasonal workers who are facing no jobs and for those who have run out of EI recently. Expanding the CERB to include people who earn up to $1,000 per month. Maybe you're a volunteer firefighter, or a contractor who can pickup some shifts, or you have a part-time job in a grocery store."

Applications for the Canada Emergency Business Account starts TODAY!

The new Canada Emergency Business Account (CEBA) is available starting TODAY and is available through major banking institutions.

The CEBA will provide qualifying businesses an interest-free loans of up to $40,000 until December 31, 2022.

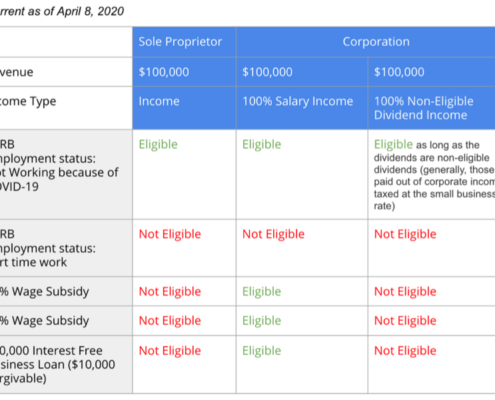

Rules changed to allow more struggling business owners access to CERB, Wage Subsidy. Summer jobs program increased to 100%

A big win today for some small business owners who previously did not qualify for the $500/week Canada Emergency Response Benefit (CERB) or the 75% Canada Emergency Wage Subsidy (CEWS).

Accepting Applications starting April 6th – Canada Emergency Response Benefit (CERB)

The sheer volume of applications for the Canada Emergency Response Benefit (CERB) will likely overwhelm the system. If you or someone you know need to apply for this benefit, we suggest you prepare TODAY before the applications begin:

Double check your myCRA account username and password

Setup Direct Deposit with CRA

Tax Loss Selling

Over the last few weeks, the financial market has taken a downturn amidst fears over Coronavirus.

Understandably, you are concerned with your portfolio, it’s important to stay level-headed to avoid making financial missteps. However, staying level-headed doesn’t necessarily mean you sit there and do nothing. In fact, one consideration you can look is taking an active tax management approach.

Tax loss selling is a strategy to crystallize or realize any capital losses in your non-registered accounts so it can be used to offset any capital gains.

Do I Qualify for the Canada Emergency Response Benefit & EI?

To help Canadians through this difficult time, the Federal Government created the Canada Emergency Response Benefit (CERB) and made changes to the Employment Insurance Program (EI). For those whose employment has affected by the Coronavirus, we have created a chart to help you figure out which program you qualify for and provide links to apply for each program.