Retirement Planning for Business Owners – Checklist

As a business owner, one of your challenges is learning how to balance between reinvesting into the business and setting money aside for personal savings. Since there are no longer employer-sponsored pension plans and the knowledge that retirement will come eventually, it’s important to have a retirement plan in place.

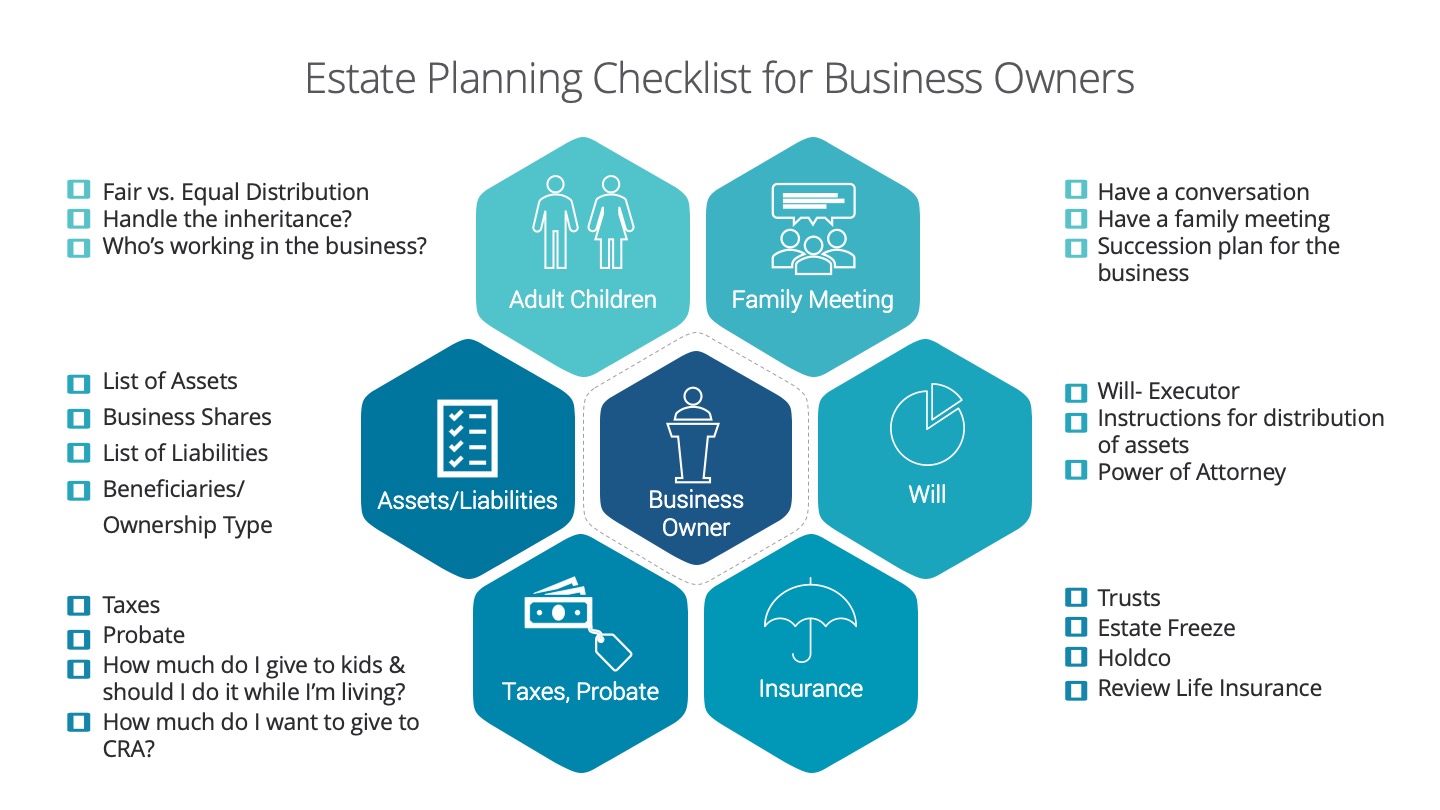

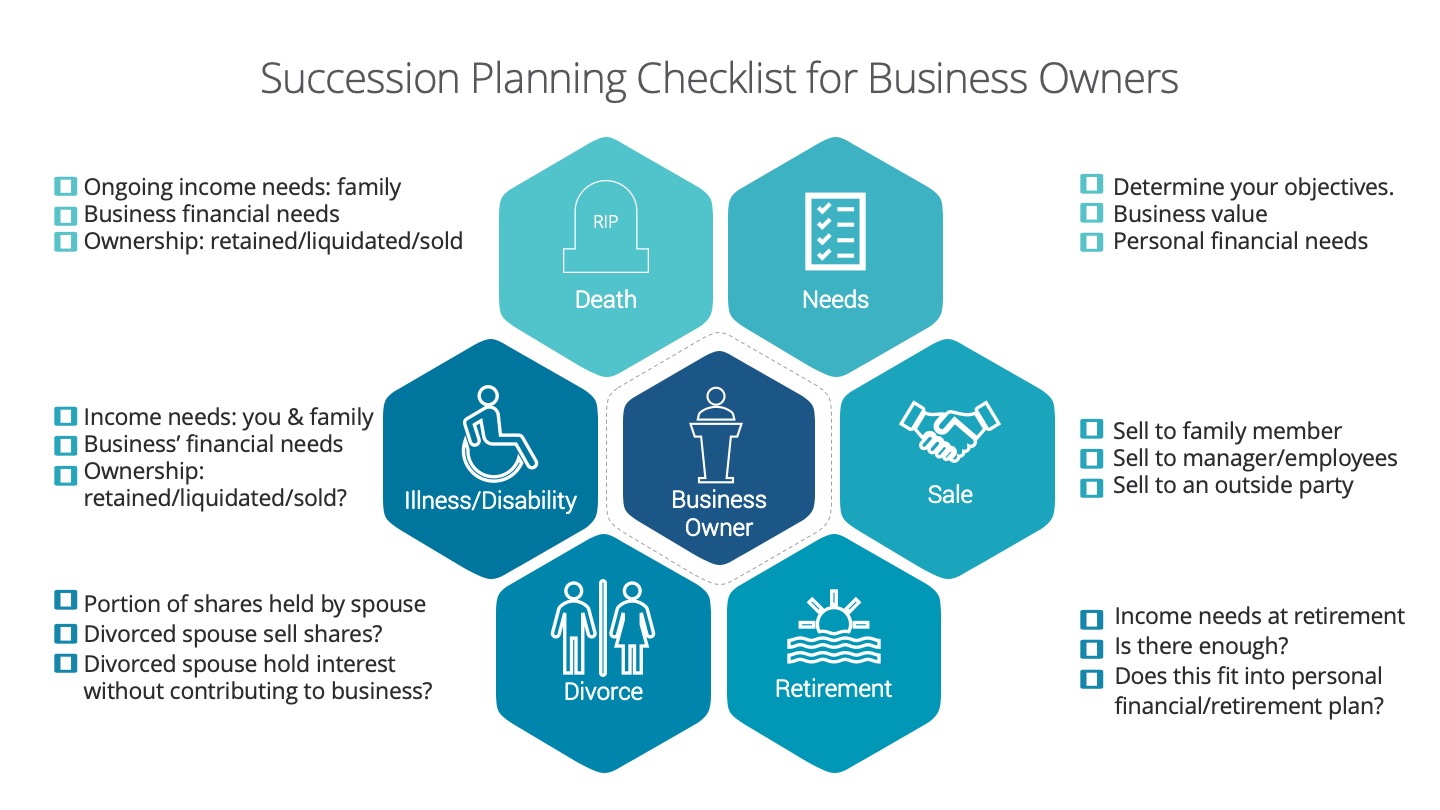

We’ve put together an infographic checklist that can help you get started on this. We know this can be a difficult conversation so we’re here to help and provide guidance to help you achieve your retirement dreams.

Income Needs

-

Determine how much income you will need in retirement.

-

Make sure you account for inflation in your calculations.

Debts

-

You should try to pay off your debts as soon as you can; preferably before you retire.

Insurance

-

As you age, your insurance needs change. Review your insurance needs, in particular your medical and dental insurance because a lot of plans do not provide health plans to retirees.

-

Review your life insurance coverage because you may not necessarily need as much life insurance as when you had dependents and a mortgage, but you may still need to review your estate and final expense needs.

-

Prepare for the unexpected such as a critical illness or a need for long-term care.

Government Benefits

-

Check what benefits are available for you upon retirement.

-

Canada Pension Plan- decide when would be the ideal time to apply and receive CPP payments. Business owners are in a unique position to control how much can be contributed to CPP by deciding to pay salary or dividends. (Dividends don’t trigger CPP contributions.)

-

Old Age Security- check pension amounts and see if there’s a possibility of clawback.

-

Guaranteed Income Supplement- if your income is low enough, you could apply for GIS.

Income

-

Are you a candidate for an individual pension plan (IPP)? IPPs can provide higher contributions than typically permitted to an RRSP and the ability to create a lifelong pension.

-

Check if your business is a candidate for a group RRSP or company pension plan. This is a great way for you to build retirement savings and provide benefits for your employees and business too.

-

Make sure you are saving on a regular basis towards retirement- in an RRSP, TFSA, or non-registered account. As you can control how you get paid, you should make sure you have the optimal mix of salary and dividends to achieve your financial goals. Dividends are not considered eligible income to create RRSP room.

-

Ensure your investment mix makes sense for your situation.

-

Don’t forget to check if there are any other income sources. (e.g. rental income, side hustle income, etc.)

Assets

-

The sale of your business can be part of your retirement nest egg. Therefore, you should make sure you know the valuation of your business and your plan to sell the business to your family, employees, partners or a third party. You should also know when you decide to sell your business.

-

Are you planning to use the sale of your home or other assets to fund your retirement?

-

Will you be receiving an inheritance?

One other consideration that’s not included in the checklist is divorce. This can be an uncomfortable question; however, divorce amongst adults ages 50 and over is on the rise and this can be financially devastating for both parties.

Next steps…

-

Contact us about helping you get your retirement planning in order so your retirement dreams can be achieved.