2025 Ontario Budget

Ontario Budget 2025

Ontario’s 2025 Budget focuses on holding tax rates steady while introducing targeted cost-of-living relief, business supports, and retirement security measures. Recognizing the economic strain caused by ongoing U.S. tariffs on key Ontario industries, the government is also providing billions in business relief, tax deferrals, and community support to help protect jobs and local economies.

For Families

The budget brings some meaningful relief for families facing rising everyday expenses. While personal tax rates remain unchanged, a new tax credit has been introduced to support those growing their families.

What’s Changing for Families:

-

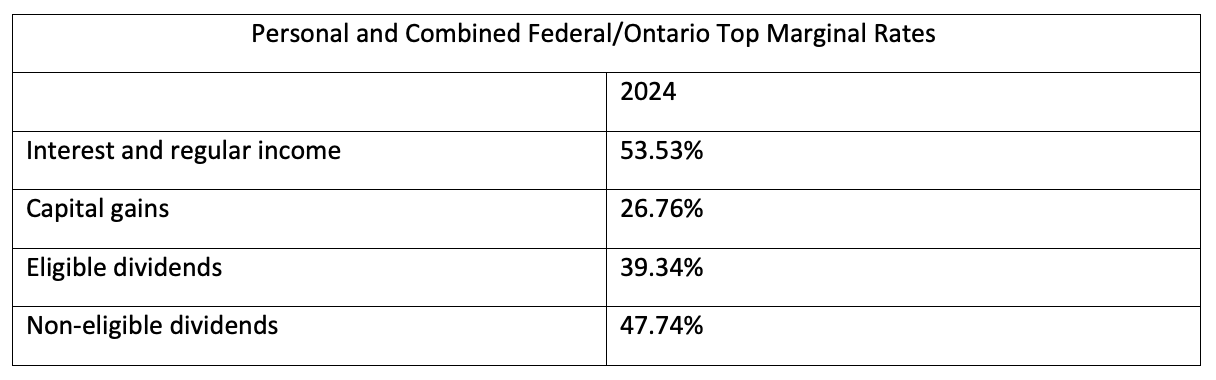

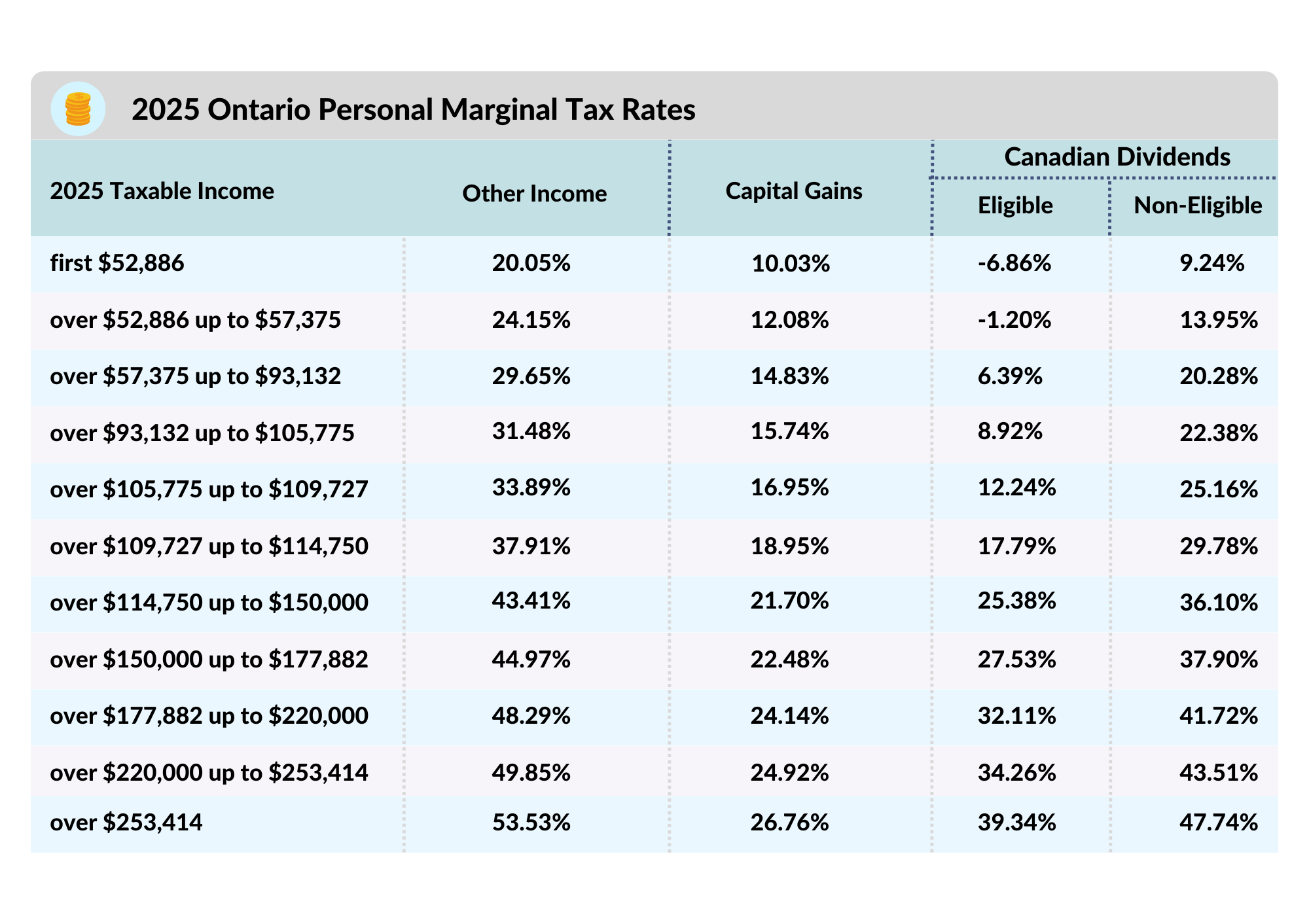

No change to personal tax rates.

In addition to tax stability, the government is offering relief on everyday expenses to help ease the cost of living. This includes a $200 one-time payment provided earlier this year to assist with rising household costs. Public transit riders can take advantage of the One Fare program, which could save frequent users up to $1,600 per year by eliminating extra charges when transferring between transit systems.

For families planning to grow, the new Ontario Fertility Treatment Tax Credit offers financial support by covering 25% of eligible fertility expenses, up to $5,000 per year, even if no taxes are owed.

Expanded Access to Services:

-

$2.1 billion investment to connect all Ontarians with a family doctor or care team

-

$56 billion for hospital expansions, adding 3,000 new beds

-

$30 billion for new schools and childcare spaces, including 20,500 new STEM education seats

For Business Owners

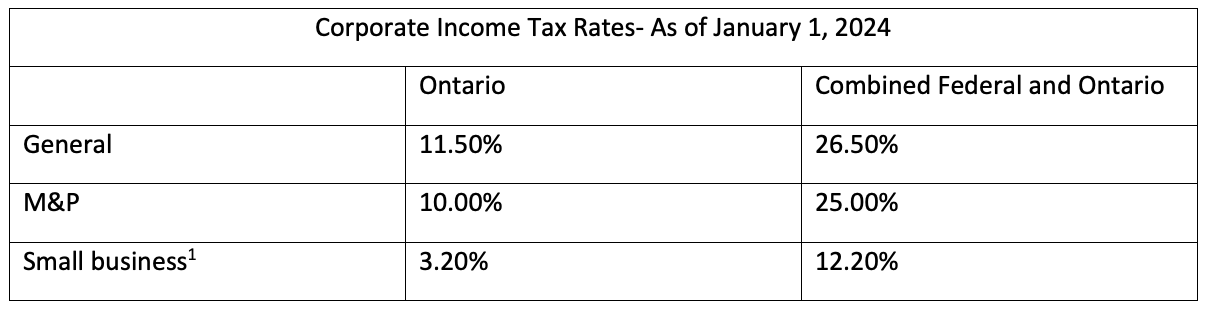

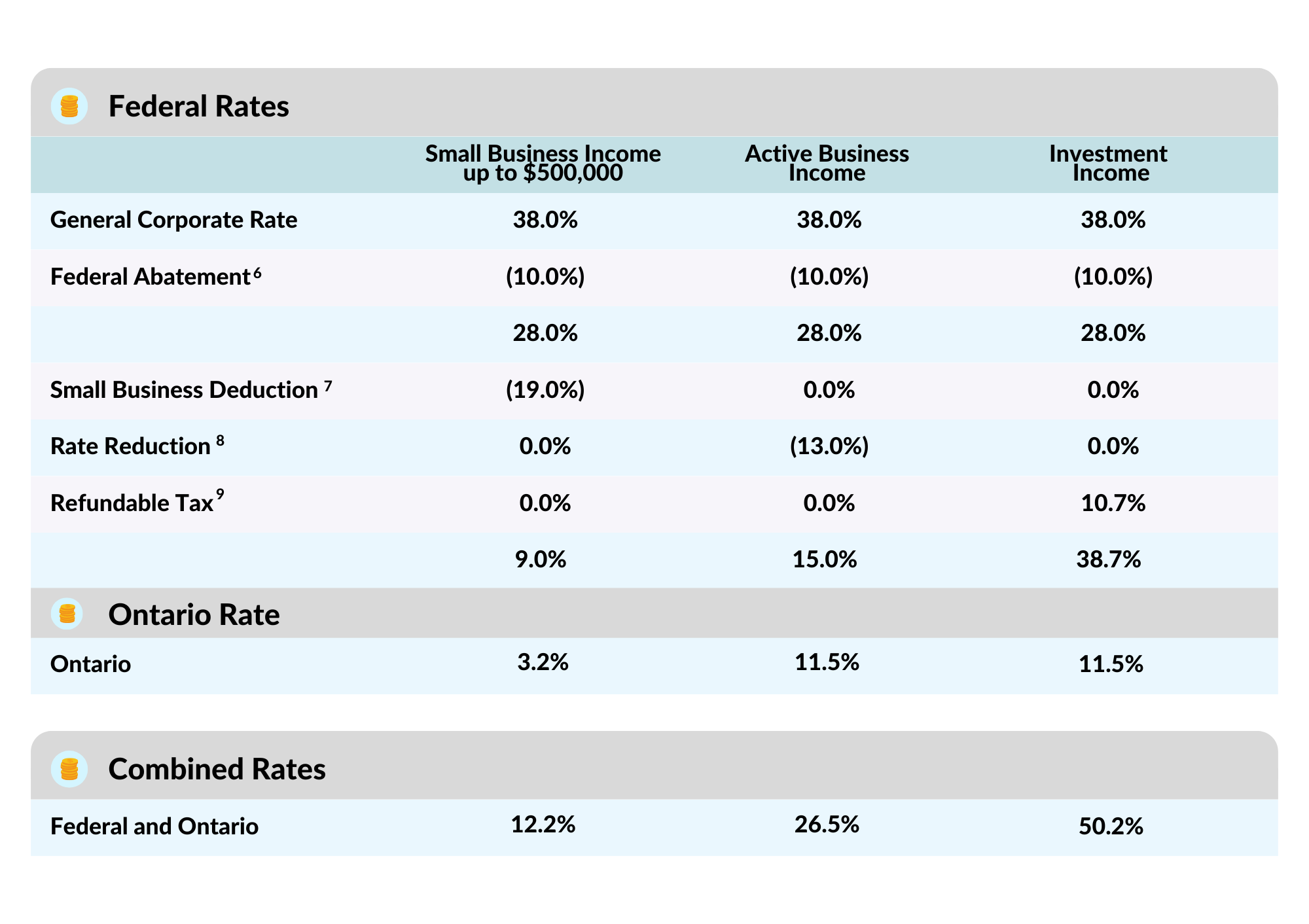

While tax rates for businesses remain unchanged, the budget introduces expanded supports to help businesses manage cash flow and invest in growth.

Business Tax Highlights:

-

No change to corporate tax rates:

Key Supports for Businesses:

-

Tax deferral on select Ontario taxes until October 1, 2025, offering up to $9 billion in liquidity for 80,000 businesses

-

Enhanced Manufacturing Investment Tax Credit: Increased to 15% on up to $20 million annually in qualifying investments until 2030

-

$4 billion in Workplace Safety and Insurance Board rebates and $150 million in ongoing premium savings

-

$5 billion Protecting Ontario Account for businesses impacted by tariffs

-

$50 million Ontario Together Trade Fund to help businesses retool and diversify markets

-

$500 million Critical Minerals Processing Fund to boost Ontario’s mining and battery supply chain

Workforce and Infrastructure Investments:

-

$1 billion for job training and workforce programs

-

$750 million for expanding STEM education

-

$2.3 billion over 4 years for municipal housing infrastructure to support community and economic growth

For Retirees

Retirees will see stability in tax rates and small, meaningful cost-of-living supports. There are no new taxes on retirement income, RRIF withdrawals, or investment earnings, providing financial consistency for those in retirement.

Tax Stability for Retirees:

-

No change to taxes on pensions, RRIF withdrawals, or investment income:

Everyday Savings for Seniors:

-

Permanent 9-cent-per-litre gas tax cut

-

Alcohol tax reductions starting August 1, 2025, lowering prices on wine, beer, and ready-to-drink beverages

Health and Housing Supports for Seniors:

-

$56 billion for hospital expansions, adding 3,000 new beds

-

$6.4 billion since 2019 for 58,000 long-term care beds by 2028

-

Up to 35% property tax reduction on affordable rental housing starting in 2026

In Summary

Ontario’s 2025 Budget provides small but meaningful supports across the board. Families benefit from cost-of-living rebates, transportation savings, and improved healthcare and education. Business owners gain liquidity relief, investment incentives, and programs to help diversify and grow. Retirees enjoy tax stability, lower daily costs, and expanded healthcare and housing options.

Ready to take action?

If you’d like to discuss how these changes could impact your financial, business, or retirement plans, we encourage you to reach out. Book a consultation today to ensure you’re making the most of the opportunities available.

Sources:

Government of Ontario. “Building a Better Ontario: 2025 Ontario Budget.” https://budget.ontario.ca/2025/pdf/2025-ontario-budget-en.pdf.

KPMG Canada. “Highlights of the 2025 Ontario Budget.” https://assets.kpmg.com/content/dam/kpmg/ca/pdf/tnf/2025/05/ca-highlights-of-the-2025-ontario-budget.pdf .

Canada Revenue Agency. Canadian Income Tax Rates for Individuals – Current and Previous Years. Government of Canada, https://www.canada.ca/en/revenue-agency/services/tax/individuals/frequently-asked-questions-individuals/canadian-income-tax-rates-individuals-current-previous-years.html

Canada Revenue Agency. “Corporation Tax Rates.” Government of Canada, https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/corporations/corporation-tax-rates.html.